THE ANALYSIS TOOL

Finvaley is an analysis and comparison tool in which buying and selling decisions for securities are made primarily with reference to the so-called "intrinsic value".

This interpretation was shaped primarily by the teachings and methods of Benjamin Graham and Warren Buffet. The investment approach is therefore associated with fundamental analysis. Our analysis method differs fundamentally from investment strategies that are based on technical analysis and momentum and thus usually only consider the past development of the market price.

Finvaley is particularly suitable for those investors who want an investment horizon of 5, 10 or more years. It also makes it easier to enter the stock market, since no prior knowledge is required for such an analysis.

Independently

Finvaley can provide its ratings completely independently of corporate interests. Neither funds nor other products have to be sold! Only factual key figures from the company's financial reports are used. This guarantees privileged access to high quality and objective analysis.

Transparent

Independent

You make your investment decisions completely independently. All information on finvaley.com Site or those obtained in electronic or non-electronic form through Stockanalyzer API are for informational purposes. Stockanalyzer GmbH is not an investment advisory company and in no way carries out investment or financing advisory activities.

THE FINVALEY ANALYSIS

With the Finvaley analysis you see Within seconds, whether your chosen stock at the current time cheap or expensive to to buy is.

Our traffic light system green-yellow-red ensures a quick and easy overview of the current status quo of the share.

To give you a more accurate picture of the share, we analyze a wide range of key figures from the balance sheet so that you can display your favorite key figures at any time. In addition, the percentage in brackets shows the position in the respective branch (100% = best in the branch)

the $1 requirement (how well the company invests in itself) and the safety margin (intrinsic value to market price) are also fixed components of our analysis and complete the Finvaley analysis based on the value investment strategy.

THE COMPARISON PAGE

Everyone compares their electricity, mobile phone tariffs and much more these days! From now on you can also compare your desired stocks in order to be able to make the best selection!

The comparison makes you safe!

On your personal comparison page you have the ideal side-to-side comparison of all selected stock analyses. Add any stock to keep an eye on multiple analyzes at the same time and to be able to compare them better.

THE PORTFOLIO

Your personal share case, always with you.

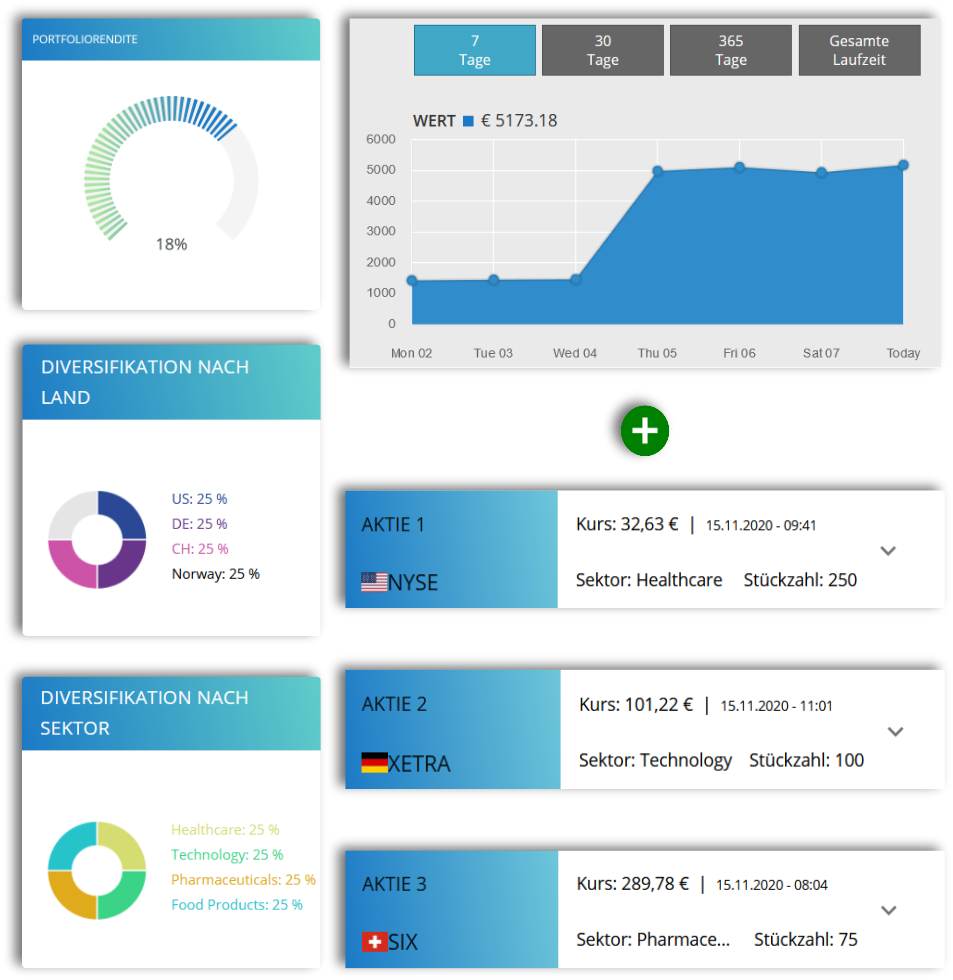

Add bought and sold stocks to your personal portfolio and keep track of returns and trends with the automatically generated charts and diagrams.

In addition, we inform you about the average buying and selling price of each individual company in your portfolio.

✓ curve

✓ portfolio return

✓ Diversification by country

✓ Diversification by industry

CURRENT EXCHANGE RATE &

BALANCE SHEET DATA

More information and always up to date?

In der Finvaley Web-App finden Sie zu jeder Aktie auch den aktuellen Kurs sowie historische Daten und das mehrmals täglich aktualisiert.

The current balance sheet data includes over 40 different key figures from the following areas:

✓ assets

✓ liabilities

✓ result

✓ staff

✓ valuation

✓ stability

✓ distribution

✓ profitability

✓ liquidity situation

They find out more about the individual key figures!